Balancing Charges Hmrc . Web hmrc prevents claiming excess relief through balancing charges by monitoring the disposal of assets and comparing the. Web this guide will help you fill in the correct boxes on your tax return when you make a claim for capital allowances. For this, you add a. It arises when a business sells, disposes of, or. Web an adjustment, known as a balancing charge, may arise when you sell an asset, give it away or stop using it in. Web these include the following: Web a balancing charge is calculated when you sell a piece of equipment at a higher tax written down value. Web a balancing charge is a concept within the uk's capital allowances framework. Web hs252 capital allowances and balancing charges 2022.

from help.invoicing-software.com

Web a balancing charge is a concept within the uk's capital allowances framework. Web these include the following: Web this guide will help you fill in the correct boxes on your tax return when you make a claim for capital allowances. Web hmrc prevents claiming excess relief through balancing charges by monitoring the disposal of assets and comparing the. Web a balancing charge is calculated when you sell a piece of equipment at a higher tax written down value. It arises when a business sells, disposes of, or. Web an adjustment, known as a balancing charge, may arise when you sell an asset, give it away or stop using it in. For this, you add a. Web hs252 capital allowances and balancing charges 2022.

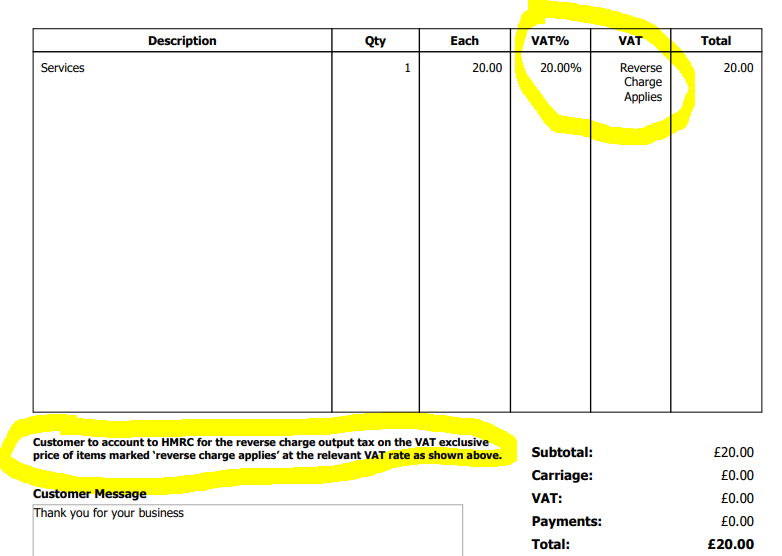

UK HMRC VAT Reverse Charge Support SliQ Invoicing Online Help

Balancing Charges Hmrc It arises when a business sells, disposes of, or. Web this guide will help you fill in the correct boxes on your tax return when you make a claim for capital allowances. For this, you add a. Web hmrc prevents claiming excess relief through balancing charges by monitoring the disposal of assets and comparing the. Web hs252 capital allowances and balancing charges 2022. Web a balancing charge is a concept within the uk's capital allowances framework. It arises when a business sells, disposes of, or. Web these include the following: Web a balancing charge is calculated when you sell a piece of equipment at a higher tax written down value. Web an adjustment, known as a balancing charge, may arise when you sell an asset, give it away or stop using it in.

From help.invoicing-software.com

UK HMRC VAT Reverse Charge Support SliQ Invoicing Online Help Balancing Charges Hmrc Web a balancing charge is a concept within the uk's capital allowances framework. Web an adjustment, known as a balancing charge, may arise when you sell an asset, give it away or stop using it in. Web hmrc prevents claiming excess relief through balancing charges by monitoring the disposal of assets and comparing the. Web this guide will help you. Balancing Charges Hmrc.

From businessadviceservices.co.uk

Sample HMRC Letters Business Advice Services Balancing Charges Hmrc Web an adjustment, known as a balancing charge, may arise when you sell an asset, give it away or stop using it in. It arises when a business sells, disposes of, or. Web a balancing charge is calculated when you sell a piece of equipment at a higher tax written down value. Web hs252 capital allowances and balancing charges 2022.. Balancing Charges Hmrc.

From www.youtube.com

Water Chemistry 3 Charge Balance and ANC YouTube Balancing Charges Hmrc Web hs252 capital allowances and balancing charges 2022. Web an adjustment, known as a balancing charge, may arise when you sell an asset, give it away or stop using it in. Web this guide will help you fill in the correct boxes on your tax return when you make a claim for capital allowances. Web a balancing charge is a. Balancing Charges Hmrc.

From www.youtube.com

[2.2b] ChargeBalance Equation สมการดุลประจุ YouTube Balancing Charges Hmrc Web this guide will help you fill in the correct boxes on your tax return when you make a claim for capital allowances. It arises when a business sells, disposes of, or. For this, you add a. Web these include the following: Web a balancing charge is calculated when you sell a piece of equipment at a higher tax written. Balancing Charges Hmrc.

From www.coursehero.com

[Solved] Balancing charges Suppose that X represents an arbitrary Balancing Charges Hmrc Web this guide will help you fill in the correct boxes on your tax return when you make a claim for capital allowances. Web a balancing charge is calculated when you sell a piece of equipment at a higher tax written down value. Web these include the following: Web an adjustment, known as a balancing charge, may arise when you. Balancing Charges Hmrc.

From dokumen.tips

(PDF) Capital allowances and balancing charges · Capital allowances and Balancing Charges Hmrc For this, you add a. Web a balancing charge is calculated when you sell a piece of equipment at a higher tax written down value. Web hmrc prevents claiming excess relief through balancing charges by monitoring the disposal of assets and comparing the. Web this guide will help you fill in the correct boxes on your tax return when you. Balancing Charges Hmrc.

From www.studocu.com

6. Capital Allowance QPE Notes CHAPTER 6 CAPITAL ALLOWANCES AND Balancing Charges Hmrc Web a balancing charge is calculated when you sell a piece of equipment at a higher tax written down value. Web hmrc prevents claiming excess relief through balancing charges by monitoring the disposal of assets and comparing the. Web these include the following: Web this guide will help you fill in the correct boxes on your tax return when you. Balancing Charges Hmrc.

From www.parahyena.com

Hmrc Invoice Template Balancing Charges Hmrc It arises when a business sells, disposes of, or. For this, you add a. Web hs252 capital allowances and balancing charges 2022. Web a balancing charge is a concept within the uk's capital allowances framework. Web these include the following: Web hmrc prevents claiming excess relief through balancing charges by monitoring the disposal of assets and comparing the. Web this. Balancing Charges Hmrc.

From old.sermitsiaq.ag

Basic Balance Sheet Template Balancing Charges Hmrc It arises when a business sells, disposes of, or. Web hmrc prevents claiming excess relief through balancing charges by monitoring the disposal of assets and comparing the. Web these include the following: Web hs252 capital allowances and balancing charges 2022. Web this guide will help you fill in the correct boxes on your tax return when you make a claim. Balancing Charges Hmrc.

From go-e.com

The Benefits of Wallbox with Dynamic Load Balancing goe Balancing Charges Hmrc For this, you add a. Web hmrc prevents claiming excess relief through balancing charges by monitoring the disposal of assets and comparing the. Web this guide will help you fill in the correct boxes on your tax return when you make a claim for capital allowances. Web a balancing charge is a concept within the uk's capital allowances framework. It. Balancing Charges Hmrc.

From accotax.co.uk

WHAT is a Balancing Charge? Accotax Balancing Charges Hmrc It arises when a business sells, disposes of, or. Web a balancing charge is calculated when you sell a piece of equipment at a higher tax written down value. Web hs252 capital allowances and balancing charges 2022. Web this guide will help you fill in the correct boxes on your tax return when you make a claim for capital allowances.. Balancing Charges Hmrc.

From www.slideserve.com

PPT Lesson PowerPoint Presentation, free download ID3761913 Balancing Charges Hmrc Web hs252 capital allowances and balancing charges 2022. Web an adjustment, known as a balancing charge, may arise when you sell an asset, give it away or stop using it in. Web hmrc prevents claiming excess relief through balancing charges by monitoring the disposal of assets and comparing the. Web these include the following: For this, you add a. It. Balancing Charges Hmrc.

From xispactre.blogspot.com

How To Calculate Balancing Charge And Balancing Allowance Malaysia Balancing Charges Hmrc It arises when a business sells, disposes of, or. Web a balancing charge is a concept within the uk's capital allowances framework. Web these include the following: For this, you add a. Web hs252 capital allowances and balancing charges 2022. Web hmrc prevents claiming excess relief through balancing charges by monitoring the disposal of assets and comparing the. Web an. Balancing Charges Hmrc.

From imagetou.com

Hmrc Ni Allowances 2023 2024 Image to u Balancing Charges Hmrc Web hmrc prevents claiming excess relief through balancing charges by monitoring the disposal of assets and comparing the. Web a balancing charge is calculated when you sell a piece of equipment at a higher tax written down value. For this, you add a. Web this guide will help you fill in the correct boxes on your tax return when you. Balancing Charges Hmrc.

From www.coursehero.com

[Solved] Incements Balancing charges Suppose that X represents an Balancing Charges Hmrc Web hs252 capital allowances and balancing charges 2022. Web a balancing charge is calculated when you sell a piece of equipment at a higher tax written down value. Web a balancing charge is a concept within the uk's capital allowances framework. Web hmrc prevents claiming excess relief through balancing charges by monitoring the disposal of assets and comparing the. Web. Balancing Charges Hmrc.

From zaniyah-has-velasquez.blogspot.com

Company Tax Computation Format Malaysia ZaniyahhasVelasquez Balancing Charges Hmrc Web these include the following: It arises when a business sells, disposes of, or. Web a balancing charge is a concept within the uk's capital allowances framework. Web a balancing charge is calculated when you sell a piece of equipment at a higher tax written down value. Web hs252 capital allowances and balancing charges 2022. Web hmrc prevents claiming excess. Balancing Charges Hmrc.

From www.pinterest.com

Balancing Charges in Chemical Formulas Chemistry classroom, High Balancing Charges Hmrc Web these include the following: For this, you add a. Web hmrc prevents claiming excess relief through balancing charges by monitoring the disposal of assets and comparing the. Web hs252 capital allowances and balancing charges 2022. Web a balancing charge is a concept within the uk's capital allowances framework. It arises when a business sells, disposes of, or. Web a. Balancing Charges Hmrc.

From www.youtube.com

Balancing Charge YouTube Balancing Charges Hmrc Web these include the following: Web this guide will help you fill in the correct boxes on your tax return when you make a claim for capital allowances. Web an adjustment, known as a balancing charge, may arise when you sell an asset, give it away or stop using it in. Web a balancing charge is calculated when you sell. Balancing Charges Hmrc.